A Sari, Economics, and Actionable Market Intelligence

Actionable market intelligence has the power to align your requirements, improve collaboration with potential suppliers, and put you in the driver’s seat at the negotiation table.

By Raj Sharma

A few years ago, as I was about to leave for the airport for a trip to India, my wife tapped me on my shoulder and asked, “Can you buy me a sari while you are in Delhi?”

A few years ago, as I was about to leave for the airport for a trip to India, my wife tapped me on my shoulder and asked, “Can you buy me a sari while you are in Delhi?”

“A sari?” I said with a nervous look. What did I know about buying an Indian sari, the traditional dress worn by Indian women? “I’ve never bought one before myself. Is there a particular style or color? Where do I go to buy one? How much should I pay?” I was trying to better understand the requirements and the market.

My predicament may have been preparing to buy a sari, but the situation was not that different from what innovation programs and acquisition teams face every day – finding the best solution at the right price for a specific need. In other words, it was a market intelligence assignment.

The Market Intelligence Challenge

As many of us know, we often start with unclear requirements as program managers or contracting officers. We then have to navigate complex and fast changing markets, identify potential solutions and companies, negotiate the best deal, and ensure our program is set up for success. Information and research are key. But that itself is a complex task, given fragmented and often incomplete data that is available to us. So what are we to do?

For more than 20 years, I have been fortunate to work with luminaries in supply chain management and purchasing such as David Nelson, the first head of Supply Chain and Purchasing for Honda of America. I’ve also supported or led dozens of complex supply chain and purchasing projects, including Gateway for hard disk drives, Rio Tinto for complex mining equipment, and the U.S. Navy for microelectronics.

I have learned that knowledge about suppliers and markets is the most important activity in the requirement-setting and purchasing process.

I believe Nelson summed it up best when he said, “The Honda buyers often know more accurately what the supplier’s parts costs are than the suppliers do.” (1) Buyers in all industries can conduct market research and learn from experience to gain similar levels of knowledge. That not only puts them in a better position to negotiate, but more importantly, leads to better requirements and faster integration of innovations produced by companies.

Nelson’s insight is not unique. In fact, it is well established as part of basic economic theory that all parties must have equal information as part of any effective buyer/seller transaction. (2)

When one party is not well researched and informed, we have information asymmetry, a situation where one party has more information than another, as illustrated in Figure 1.

A great example of the adverse impact of information asymmetry is in situations when government agencies issue requirements that are not aligned with supplier capabilities and develop pricing models that are different than the way suppliers do business. The impact may be fewer and less qualified companies coming to the table due to misalignment of requirements and the way government wants pricing.

Adopting a World-Class Market Intelligence Mindset

So, what can we do to make sure we are researching the market, understanding suppliers, and avoiding the predicament of information asymmetry?

More than any specific process, it starts with a mindset shift – that’s the “secret sauce” of success in mastering market intelligence.

Too often, I hear things that I know will lead to poor market intelligence:

• “I already know this market because I’ve been in it for so long.” The world and every market out there is changing fast and being disrupted through technology. So any assumption that you already know the market is probably not true.

• “I don’t trust what companies tell me because it’s all marketing.” Starting any relationship with a negative view of the other party is a recipe for disaster.

• “I don’t have time to do thorough research.” Efficient and focused market research does not necessarily require an inordinate amount of time, as you’ll see when we discuss the approach.

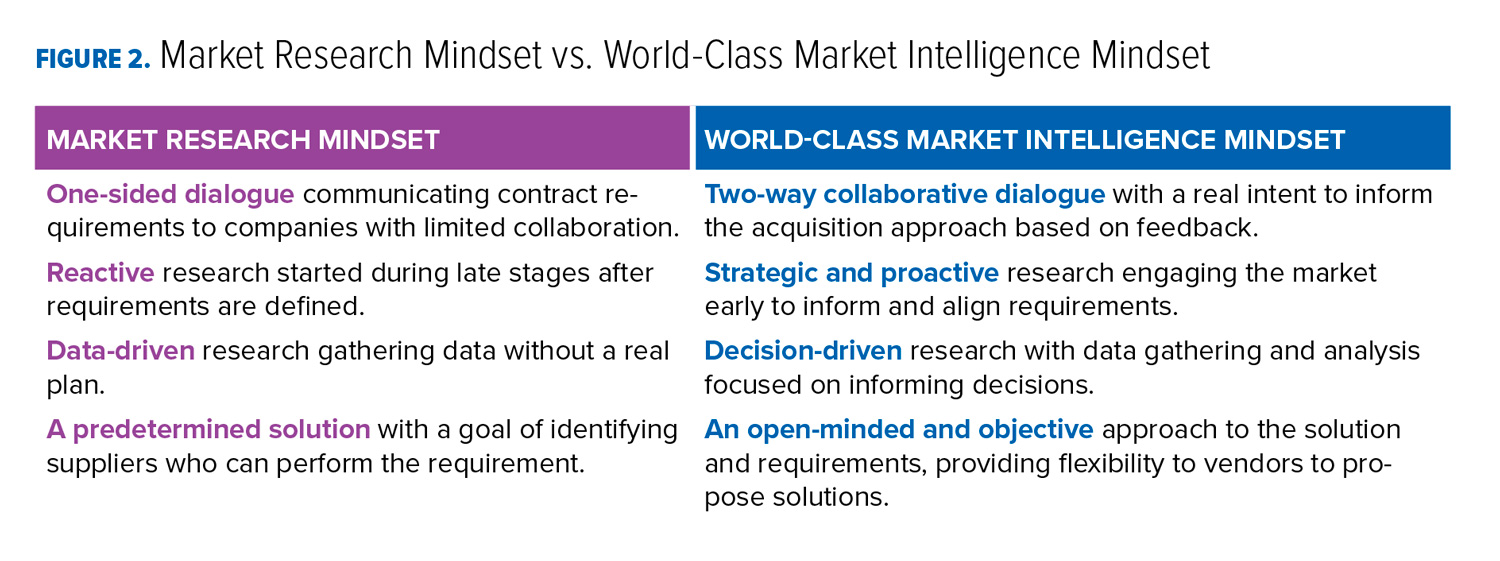

Making specific adjustments in how you approach gathering information can make a big difference. Figure 2 shows how the traditional market research mindset compares with a world-class market intelligence mindset.

The key tenets of achieving a “World-Class Market Intelligence Mindset” as described in Figure 2 can be explained this way:

• Two-way collaborative dialogue (vs. one-sided lectures) – Stop holding typical industry days where it seems like it’s the government communicating requirements to companies. Instead, make it a two-way dialogue from the beginning. Understand not only the technical aspects of companies you are engaging, but be empathetic and listen to other concerns, especially of smaller firms. For example, recently I saw a key personnel requirement that would’ve eliminated many smaller firms. The General Services Administration, in this case, removed the requirement after listening to its suppliers.

• Strategic and proactive research (vs. reactive) – Market intelligence starts at the beginning of any program or project. No requirements should be written, and no acquisition strategy should be proposed until you have spoken to companies and/or done some amount of research.

• Decision-driven research (vs. data driven) – Actionable market intelligence is about informing critical decisions, not about data gathering. Too often, I’ve seen aimless exercises where gathering as much data as possible is the goal but it still lacks any real actionable advice.

• Open-minded approach (vs. predetermined solutions) – Be open to new approaches and innovations, especially if you’re involved in technology programs. For example, for a border security requirement, while the Department of Homeland Security assumed a “wall” would be critical to protect the border, it left open opportunities for a myriad of technologies (e.g., drones, video monitoring, satellites).

Four Steps to Market Intelligence

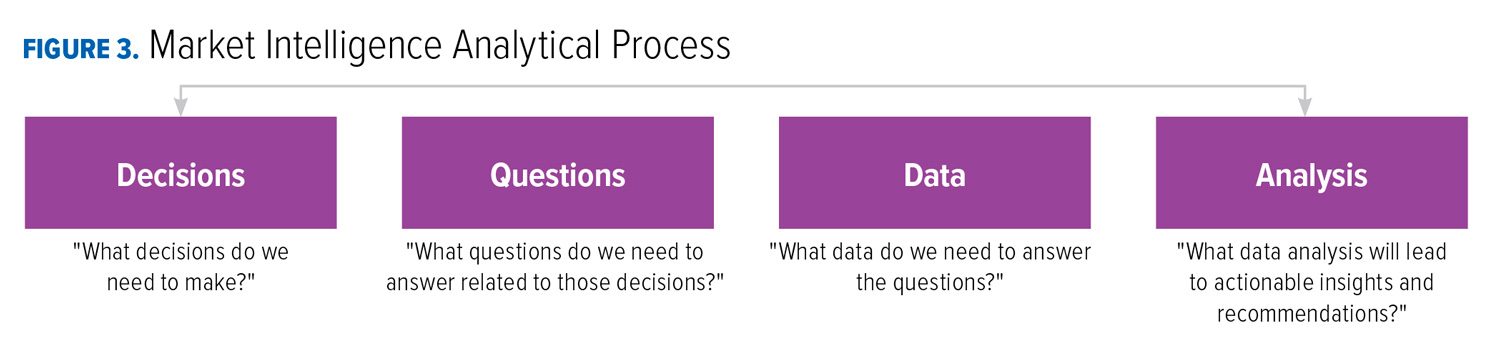

The right mindset paves the way to move on to the process of gathering and analyzing market intelligence. The process is not much different than any other research. Yes, the questions and the data required vary but the process is very much the same.

The goals of the process are to:

1. Understand decisions that need be made (e.g., develop a technology roadmap, define requirements aligned to the market, determine if a requirement should be a “set-aside,” etc.)

2. Ask questions that are related to those decisions (e.g., what technology is emerging and how would it address needs).

3. Collect the data needed to answer the questions (e.g., we need to review papers and speak to subject matter experts to understand technology trends).

4. Analyze data to gain insights (e.g., review multiple reports that show common trends and how those trends help address requirements).

As illustrated in Figure 3, the process is quite simple and intended to be efficient and decision driven.

The four steps needed to address the process shown in Figure 3 are described in the following sections.

Step 1 – Decide What Decision(s) You Need to Reach

Any project or program involves key decisions that must be made. Providing “actionable analysis” enables decision-makers to make informed decisions and at the same time, ensures those decisions can withstand any amount of scrutiny.

Typically, decisions fall into a few key categories:

• Requirements: Determine which specific areas to prioritize and how to align requirements to commercial market capabilities. Understanding vendor capabilities and how they support your programs goals is a critical part of supporting requirements decisions.

• Program Strategy: Develop a roadmap including which capabilities to deploy, timing and overall cost.

• Acquisition Strategy: Determine whether one or several partners/companies will be engaged. Decide whether the contract can be a “set-aside” for minority-owned companies or specific types of firms.

• Pricing and Budget: Determine the overall budget and pricing model to be used.

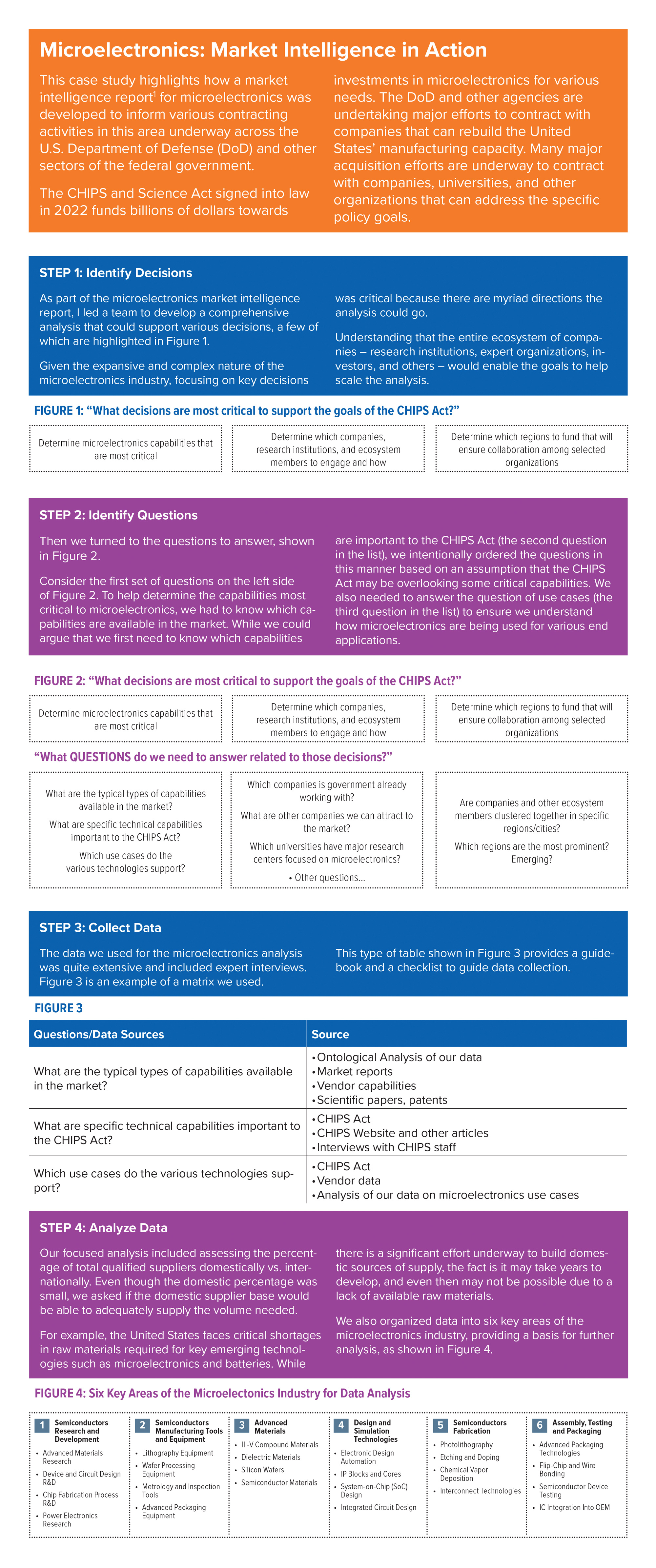

The sidebar, “Microelectronics: Market Intelligence in Action,” illustrates some specific decision points developed in a market intelligence report for a company in the microelectronics industry.

Specifics for the other three steps in the market intelligence process – Answer Questions, Collect Data, and Conduct Analysis – are also included in this case study. Given the importance of microelectronics across many government programs, this report (3) is illustrative of the type of market intelligence that can help inform decisions.

Step 2 – Determine What Questions Are Needed

Albert Einstein once said, “If I had an hour to solve a problem and my life depended on the solution, I would spend the first 55 minutes determining the proper question to ask. Once I know the proper question, I could solve the problem in less than five minutes.” (4)

I agree with Albert Einstein! The best analysts and researchers know how to ask the right questions. And they spend time critically thinking about how those questions support decisions.

The following examples of this illustrate how you can link questions to decisions:

• Decision: Determine whether to buy domestically within the United States or buy from international sources.

o Question(s): Is there a sufficient supplier base with the capabilities and capacity domestically to meet the requirements? How much capacity do we need?

• Decision: Determine the pricing model for the bid and overall budget.

o Question(s): What are the most common pricing models used by suppliers that have the right set of capabilities?

• Decision: Determine whether to break some of the requirements into niche procurements.

o Question(s): Do integrators work with some of the best niche solutions in the market and how can we ensure we get access to them if we contract with an integrator?

Note that these questions are actionable and strategic; focused on understanding market dynamics and suppliers. They also proactively seek third-party data to objectively understand market and supplier capabilities.

By contrast, more traditional market research questions would be tactical and reactive, focused on identifying suppliers and relying on those companies to respond with answers.

Step 3 – Collect Data

Data collection is where most market intelligence efforts go astray. Without a clear roadmap informed by decisions and questions, teams start collecting data aimlessly and end up with incomplete analysis to inform decisions.

The better approach is to consider the questions that need to be answered. Types of data sources can be organized as follows:

• Secondary Sources: Start with secondary research, knowing that there is likely data, reports, and information out there that someone has already collected and analyzed. These include reports from industry associations or research firms, vendor capabilities, public and private databases, and more.

• Primary Sources: Primary research is much more time-consuming but often required. Some specific sources include:

o Suppliers – Speaking with suppliers is critical. They not only provide information on capabilities but also how best to work with them, barriers they may face, etc.

o Experts – Don’t be afraid to pick up the phone and call an expert or message them on LinkedIn. You’ll be surprised at how many experts are ready to help.

• Your Organization: I’m surprised how often we ignore the wealth of knowledge that resides within our own organizations. Find out which other offices or agencies are working on the same issues. Or maybe they have engaged vendors in the same area.

Step 4: Analyze Data

Data is often analyzed along the way as it is collected. This helps determine data gaps or other questions that need answering, prompting further data collection.

Keep your analysis focused on answering the key questions or you can end up wasting a lot of time going down rabbit holes.

For example, one key decision and related questions we noted earlier were as follows:

• Decision: Determine whether to buy domestically within the United States or buy from international sources.

o Question(s): Is there a sufficient supplier base with the capabilities and capacity domestically to meet the requirements? How much capacity do we need?

Once you have collected data on suppliers from government and commercial sources, the specific analysis may be to:

• Analyze the percentage of total qualified suppliers domestically vs. internationally.

• Even if the domestic percentage is small, ask if the domestic supplier base would be able to adequately supply the volume needed.

For example, the United States faces critical shortages in raw materials required for key emerging technologies such as microelectronics and batteries. While there is a significant effort underway to build domestic sources of supply, the fact is it may take years to develop, and even then may not be possible due to a lack of available raw materials. The conclusion would be that the requirement can not limit suppliers to domestic sources and therefore international suppliers not from hostile countries would be welcome.

Back to the Sari – Finding Critical Market Intelligence

To illustrate how I applied many of the market intelligence principles, picture this:

I’m standing in a chaotic market in New Delhi, sweating profusely in what I imagine was 120-degree heat. All I see are people everywhere I look. If you’ve ever been to Times Square in New York City during a holiday, you can imagine what the scene looks like.

I’m hot. I’m nervous. I’m anxious about what lies ahead. Luckily, I had done my market research and learned the information I needed to be a sari buyer.

My uncle, who lived in Delhi, happened to know a lot about saris. I’m not sure why he knew about saris, but that’s another story. After I told him about my predicament, he took time to ask me some very smart questions. What occasion is the sari for? What styles does my wife prefer?

After learning the answers to those questions and more, he provided his sage advice (this was my data collection) on which part of New Delhi to go to and which stores to consider. I trusted his advice because he had lived in Delhi for decades and knew every corner of the city. A trusted source turned out to be the only data source I needed; a source I could trust.

After stumbling through a few stores, I was at the place where I would ultimately cut a deal. As I talked to one of the salesmen, he started throwing saris down on the table one by one. Pretty soon, the entire table was covered with saris. After a bit of indecisiveness, I was able to pick out what I hoped would be the sari of my wife’s dreams.

Now it was time to negotiate. Just then, I remembered some important insight that my uncle had given me: “Whatever price they tell you, offer one tenth the amount, and don’t pay any more than one quarter of the quoted price.”

This was vital information I would’ve never known if I hadn’t done my research. I had haggled before, but never that aggressively. After a bit of back-and forth negotiating, I walked out of that store with a sari at a good price.

Conclusion

The process of gaining actionable market intelligence is not complicated. All it requires is a focused plan that follows the steps outlined in this article.

Remember, market intelligence has the power to align your requirements, improve collaboration with potential suppliers, and put you in the driver’s seat at the negotiation table.

I encourage you to go forth and succeed! CM

Raj Sharma is founder and CEO of Public Spend Forum. He co-founded Censeo Consulting Group, and served as a Fellow at the Center for American Progress.

ENDNOTES

1 Industry Week, May 23, 2012, https://www.industryweek.com/archived-planes-trains-and-automobiles/article/22010091/supplier-relationships-key-to-hondas-healthy-profit-margins

2 https://www.oxfordreference.com/display/10.1093/oi/authority.20110803100317615

3 Public Spend Forum, October 2023, https://www.publicspendforum.net/microelectronics/

4 https://www.forbes.com/sites/nelldebevoise/2021/01/26/the-third-critical-step-in-problem-solving-that-einstein-missed/?sh=3c5f14dc3807

DISCLAIMER The articles, opinions, and ideas expressed by the authors are the sole responsibility of the contributors and do not imply an opinion on the part of the officers or members of NCMA. Readers are advised that NCMA is not responsible in any way, manner, or form for these articles, opinions, and ideas.