“Look Investors, the U.S. Government Is Interested”

Startups can use federal innovation contracts as a springboard to venture capital – up to a point.

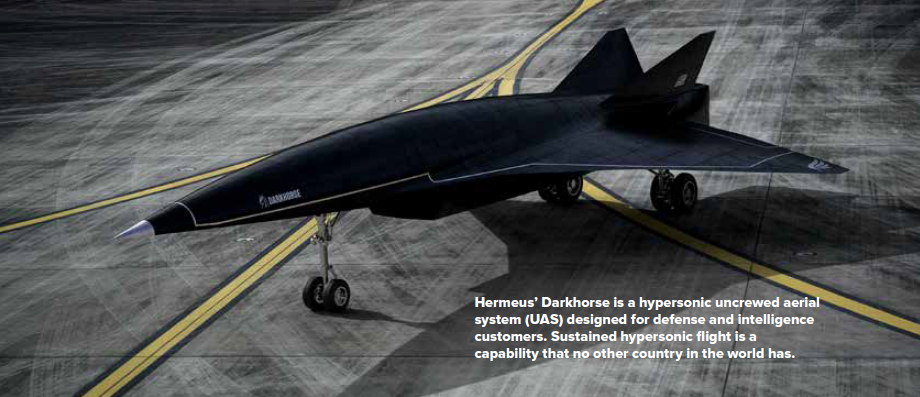

Attracting venture capital using federal innovation contracts, AJ Piplica is building a hypersonic plane. It will be able to fly 20 people from New York to London in 90 minutes traveling at Mach 5 – more than 3,000 mph.

Piplica and his co-founders of the venture-capital-backed startup Hermeus believe that flying people at that speed will increase global economic growth by $4 trillion a year. That’s a ton of cash to solve the biggest planetary problems. That vision and Hermeus’ continuing delivery of milestones toward achieving it have attracted more than $130 million in venture capital funding.

The U.S. Air Force sees solutions to some of its biggest challenges in Hermeus hypersonics. So much so that the service has invested more than $30 million. The Air Force Presidential and Executive Airlift Directorate led the $30 million investment with the Air Force Research Laboratory in 2021. It was a follow-on to a Phase II Small Business Research Innovation (SBIR) contract.

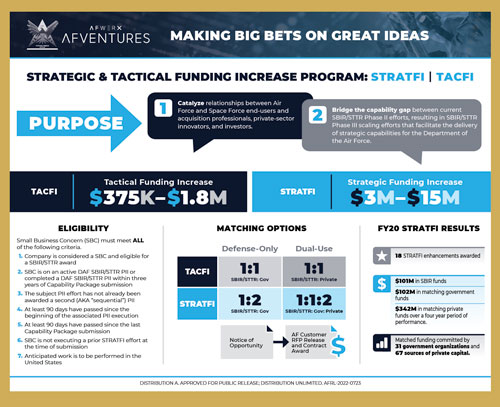

Initial Air Force support came through AFWERX, the service’s innovation incubator. It was created under Will Roper, former Air Force acquisition chief and now a Hermeus board member, who believes government should be seeding new industries. AFWERX’s Strategic Funding Increase (STRATFI) is intended to make big investments – four-year fixed-price contracts – in startups. Roper sees STRATFI as the model of a national strategy for seeding the U.S. market to build new industries in the most promising, farthest-out areas of innovation. Say, hypersonic weapons and vehicles, for example.

Roper also required government’s purchasers and operators to bleed a little. All big AFWERX investments – for example, Hermeus’ $60 million STRATFI – require internal customers like the Presidential Airlift Directorate and Air Force Research Laboratory. These are customers that put real program dollars on the table before they can reap matching funds from government and private investors. That paves the way for recurring revenue, the lifeblood of venture-capital-backed startups.

“We are transforming the Air and Space Force into an early-stage investor that leverages private capital, accelerates commercialization of technology and grows the number of companies partnering with the Department of the Air Force,” says former AFWERX director Col. Nathan Diller, who headed the group during the Hermeus STRAFI.

“Ultimately, we want to have options within the commercial aircraft marketplace for platforms that can be modified for enduring Air Force missions such as senior leader transport, as well as mobility, ISR, and possibly other mission sets,” says Brig. Gen. Jason Lindsey, Program Executive Officer of Presidential and Executive Airlift at the Air Force Life Cycle Management Center.

Hermeus’ contract with the Air Force buys research as much as high-speed planes. Requirements include increasing understanding of enabling technology and mission capabilities for reusable hypersonic aircraft. Also required are scaling and flight testing of reusable hypersonic propulsion. In addition, Hermeus is to develop an autonomous hypersonic plane.

Contract Management Editor in Chief Anne Laurent talked with Piplica in March about his route into the federal market and how his company uses SBIRs. They also discuss what contract managers can do to help startups survive long enough to deliver for government programs at full scale.

Anne Laurent (AL): What is your background? How did you end up willing to get into business with the government?

AP Piplica (AP): I’m an aerospace engineer by training. I got my bachelor’s and master’s at Georgia Tech here in Atlanta. After that, I spent about five years working for a small conceptual design company that did a lot of work for the U.S. government—the Air Force and NASA primarily—as well as some commercial work.

Then, I went from a pure engineering role to management and a leadership role in building a company, Generation Orbit, inside a small business. We set off to build a small satellite launch vehicle.1 This is really where I learned the most about working with the government. Over the course of about five years leading that company, we had a handful of Phase I and Phase II SBIR contracts. And we were able to turn one of those Phase IIs into a broad development contract.

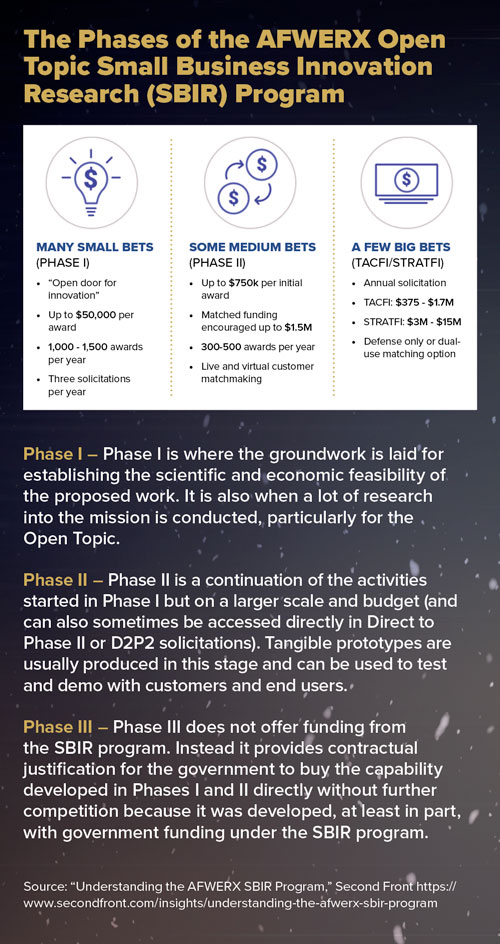

AL: What kind of money are we talking about for a Phase I SBIR? Why is that even attractive to a startup?

AP: Phase I can be between $50,000 to $200,000. It’s not a lot of money from a company’s perspective. It pays for half of a full-time-equivalent employee if you’re lucky. Phase I tends to last six months, maybe a year. The main purpose of Phase I is to write your proposal for a Phase II, which is $1 million to $1.5 million. With that, you can start to do real things like build hardware.

I care about the contract mechanism because there are so many ways you can leverage a SBIR. Once you have a Phase I SBIR, you can effectively use that as the competitive justification for future sole-source contracts. That’s the whole idea of the SBIR program. Get out of Phase I, get to Phase II, and then potentially commercialize something or bring it through transition under Phase III.

Being able to do that without having to run a whole competition is massively valuable. Of course, you still need the program support. You also need the support of the department and people to put money in the budget for transition. That’s a whole other issue.

AL: Once you get to Phase III and you’ve got something that’s commercialized, then somebody who is in government can come to you sole source. How do they even know you exist?

AP: That’s on us. We have to make sure that everybody knows us, and marketing is hugely important. If we’re not telling our story, it doesn’t matter what we’re doing or how cool and awesome the engines and planes we’re building are. If we’re not able to tell our story broadly within the stakeholder communities that are important to us and to our customers, then it doesn’t matter.

AL: You’re not part of the government and you’re in this strange little program, SBIR. How are you even getting in the door to talk to people?

AP: By smashing my head against the wall for a long time. You just start talking to people in your network, and eventually you’ll get to the right people.

Working with the government at scale requires long-term relationships with a really large swath of people. Often, you’ll work with a consulting group that has built those relationships over decades. A small company is not going to build those long-term relationships right off the bat. You’re going to have to prove yourself, build a track record, and so forth.

AL: You just received a SBIR for tens of thousands of dollars, and now you’re hiring a consulting company? With what money?

AP: We’re a venture-backed company, and we’ve raised private capital. We’re basically funding ourselves, our own research and development, business development, and sales process. The product definition side of the business also is done with our own money.

AL: In other words, unless you are a rich person starting a small company or you go out and get money somewhere else, you can’t afford to compete for government work?

AP: You can bootstrap. You can get a contract, and get more contracts. You can grow across a program like SBIR where instead of one contract you’re trying to grow and scale, you may have 10 or 20. You can build a team of reasonable size, but it takes a lot longer. If you want to move fast, you have to bring your own capital to the table. With that comes risk. I think that’s something that is not understood very well. We’ve put our own money up. If we are not successful, we don’t get anything at the end of the day.

There is a view that we’re the “tech bros.” That we are just like the venture-backed companies you’d see in the HBO television series, “Silicon Valley.” Lots of money going around and everybody’s having a good time. But the reality is we have invested every single penny we’ve got. Frankly, we’re mortgaging our futures on what we’re trying to accomplish. To deliver a radically important and leap-ahead capability for the DoD on the path to long-term commercial success.

AL: Why mortgage your future for something that might bring you a few thousand dollars and ultimately a contract only if you can sell the government enough to get its buyers to use the Phase III?

AP: The payoff on the backend is so critical. I’m addressing just the intermediate step of autonomous hypersonic aircraft flying missions for the DoD. If we’re able to deliver that five to 10 years earlier than folks are expecting, it will be a massive boon for national security. My co-founders and I come from the commercial space world. We have the technical capability to do this. This is why we started the company. We didn’t see people taking this kind of risk. We saw it as a responsibility, and if not ours, then whose?

Tie that together with the big payoff at the end of the day on the commercial side. If we’re able to accelerate the world by five times, that’s going to drive massive social and economic growth, to the tune of multiple digit points of gross domestic product growth at a global scale. So that’s really the long and short of why take this risk: the payoff on the backend. I’m not talking about money in my bank account. I’m talking about the impact that success will have on the country and on the world in a positive and sustainable way.

AL: What is the STRATFI, and how did you find out it existed? What does it actually look like? Is it a contract?

AL: What is the STRATFI, and how did you find out it existed? What does it actually look like? Is it a contract?

AP: STRATFI is a big SBIR with some interesting mechanisms. It was brought forth by AFWERX, the Air Force innovation organization, to take a crack at solving the valley of death problem.

That is the problem of transitioning from research and development into procurement when you’re working with the government. The valley of death is created primarily by the DoD Planning, Programming, Budgeting, and Execution (PPBE) process and the contracting process.

Funding within the military services has to be programmed. It has to go through the Office of the Secretary of Defense, the White House, through Congress and then back again.

What I just described is a two-year process at minimum, assuming Congress passes a budget on time. Then you have to get on contract, which also can take a year. From when your product works to when your customer in the government can pay you for it takes a minimum of three years.

That’s the valley of death. How does a company survive for a minimum of three years, maybe five, without funding?

This is the reason why the only companies that have been successful in working with the government at scale have had very wealthy founders. They bankroll the company and highly capitalize it through the valley of death.

The specific examples are SpaceX and Palantir. Anduril also is on that track in more recent times. But for SpaceX and Palantir, it took 10 years to really break in. And they broke a lot of things along the way to do it. Both of them had to sue their customer to just get a chance to compete.2

STRATFI is intended to help solve the valley of death. We knew about STRATFI because we were tied into the Air Force SBIR community. We were paying attention. It was on us to make sure we knew what kind of tools were going to be available. At the time, we were already on a Phase II SBIR with the Presidential and Executive Airlift Directorate. They were really helpful in working the internal government to put together a program like we did with STRATFI.

Our particular instantiation of STRATFI is a FAR Part 12 contract. That is not to say that it couldn’t have been something else. It was just the contracting path that our contracting officer, and the folks up his chain of command, thought was most appropriate from the government side. We would have preferred an other transaction award (OTA) given the flexibility there. But we were able to negotiate and make it work.

I prefer the OTA. When you bring the FAR into a contract, it can have radical effects on how your business works and which suppliers you use.

FAR clauses are required to be flowed down to subcontractors. Not every subcontractor is set up to work with those clauses. Cost accounting practices are a big one. Some of the security requirements also are quite onerous. Some clauses are there for a reason. But some of them are not really value-added in terms of managing risks.

I’ll give you a general example. We do R&D. We build a lot of hardware. We really like to iterate quickly. The types of machine shops that we work with are not all set up to take a clause that would fundamentally change their business. And we’re a small customer relative to the others so they’ll just no-bid the work. They’ll just say, “Hey, for this $10,000 part, I’m not going to change my business. No, thank you.” It really affects how the supply chain works. That FAR contract constrains your ability to conduct business as you wish to conduct it.

There also are internal cultural aspects. If you are on a contract that requires cost accounting, you’ve got to bring in time cards. But we don’t have people checking in every 15 minutes on which charge code they are working on. That’s not culturally who we are. We’re building airplanes, and we really push people to make the right decisions. We track expenditures against things at a higher level, but not compatible with what the FAR says. That can be a real problem.

AL: How do you get around that?

AP: The FAR only applies to what’s in the scope of the contract. For the STRATFI, the construct is $30 million in government funding. Half of that is coming from SBIR funding, half is coming from Air Force program dollars. Then, there’s a requirement for matching that funding basic

ally one to one. For every dollar that the government spends, we have to bring a dollar of private capital. The total scope of the program is $60 million, and within that there’s a $30 million contract.

The way we broke up the program was to keep all of the design, manufacturing, integration work done with private capital. That also allows us to maintain all of our intellectual property on what we’re building, which is important to us. It’s part of how we build value as a company. And it keeps the FAR out of that part. We focus the contractual effort on testing, reporting, and delivering data, not necessarily delivering an aircraft. That’s how the STRATFI was structured to manage risks on both sides.

AL: But the Air Force expects you to come up with a plane at some point, right? It’s not all data.

AP: In order to conduct the testing that’s in the scope of the contract, we need a plane that can do certain things. It’s an indirect way of saying, go build this plane.

AL: Why did the money go through the Presidential and Executive Airlift Directorate?

AP: They had a little budget in some of their recapitalization work. They wanted to spend a small chunk of it looking at emerging technologies, and how they could be potentially leveraged in the early 2030s.

Their intent is not to develop these airplanes right off the bat. But if they help us get this going, and help solve the problem of working with the government, that’s broadly a good thing for the Air Force. If, 10 years from now, we get an aircraft that can move our senior leaders around the world significantly faster, great.

They really wanted to function as an early investor knowing that they’re not necessarily going to be able to follow all the way as things progress. But small bet, big reward. Their risk is underwritten. If it turns into nothing, it is small dollars, so it’s okay. But if it does work, they get a capability at the end of the day. And the steps that we’re taking along the way are going to solve other very important national security challenges with autonomous hypersonic aircraft before we’re flying people.

The data that we’re generating is quite valuable to the Air Force Research Laboratory and they’re also supporting some of the program funding on the contract. That’s what I mean by underwriting the risk of it not working. I’m not saying we won’t deliver on the contract. Obviously, we have to do that. But this can turn into something big and have a massive reward at the end of the day. If that doesn’t happen, that’s OK, too. We’re going to manage the risk incrementally.

AL: Do contracting officers need to have a certain bent to work in this world?

AP: I think you have to understand the tools. OTs are not God’s gift to contracting or venture-backed companies. They’re just a tool in the tool chest. It’s important to understand to the fullest extent what that tool can do, and what are its constraints.

I’ve talked to some contracting officers who are not familiar with OTs and are scared of them.

There’s absolutely an education piece of it. There are success stories with OTs. Especially within NASA, where they came from. Look at the commercial orbital transportation system program. That was the first contract that SpaceX got with NASA to develop Falcon 9 and Dragon to deliver cargo to the International Space Station. That was all done within a Space Act agreement, which is essentially a very similar authority to OTs.

An OT says the FAR is not the gospel anymore. There still are other practices that you need to include. However, OTs open the aperture for creativity to deliver a more commercial-like contract. Used effectively, they can accelerate delivery of capability to the war fighter and expand the defense industrial base.

AL: How important is it to you to have a contracting officer understand what it is you’re trying to do?

AP: It’s everything. Contracting officers have the vested power and responsibility to spend money on behalf of the U.S. taxpayer. The buck stops with them.

I think building authentic relationships is important. So is trying to drive an understanding of why we’re doing things the way we are, and what the value is if we are successful. We have to go in saying, we understand there’s risk here. We know success is among the possible outcomes, but it may not be the most likely outcome. It’s worth it because of the upside if it is successful.

We have to understand the constraints that contracting officers are working within culturally. It’s very much a two-way street. The more that contracting officers understand how high-growth startups work and what success looks like, the more it helps build the common ground necessary to work together.

AL: If you were talking to a contracting class, what are the top things you would want them to know?

AP: We raise enough money for 18 months. Along with that money comes a set of technical or product development and business milestones. If we don’t hit those milestones in the time indicated, the company is dead. That timescale is critical, and it is fundamentally incompatible with the time scales in government.

If you’re able to come into government and save the taxpayer money and make a lot of money in doing so, that’s fantastic. That’s what we want at the end of the day. However, there are blockers and constraints in the way. Even on fixed-price contracts, cost and pricing justification isn’t a fun thing to go through.

I want to be incentivized to drive our cost down, and I need a reward for doing that. If you’re on a cost-type contract and you drive your cost down, you don’t get a reward, you get paid less money. I want to be in a space where the price the government pays for a product or a service is based on market pricing. Value or price is established at market rates. Then I’m incentivized to reduce my cost as much as I can to drive more profit into the company.

If that price is significantly less than what the government is already paying for something, why should it matter what profit percentage I’m getting? There are some things that if opened up a little would help with venture-backed startups. OTs allow this much more so than does the FAR. We have to move fast and have strong, healthy margins. There are aspects of the FAR that hold back both of those things.

AL: Was there any relationship between winning a STRATFI and subsequently raising $100 million dollars in Series B funds?

AP: Absolutely. This is a pattern we’ve grown through at every stage of the company. We’ve raised a little bit of venture capital. With that venture capital, we have de-risked some technology or achieved some technical milestones. That enabled us to sign a small contract with the government and repeat that cycle at larger and larger scale.

The first round of venture capital we raised was about $2 million. With that, we built and tested a subscale engine that could operate from not moving on the ground to Mach 5. After doing that, we were able to sign our first two SBIR contracts. They were about $3 million in total.

We were able to say, “Look investors, our customer in the U.S. government is interested in this. They haven’t bought anything yet, but they’re putting some skin in the game.”

We were able to leverage that into raising $16 million in private capital to build and develop our first full-scale engine for our first vehicle. After going through all that de-risking, we signed the STRATFI contract.

On the back of that we said, “There’s now significantly more capital coming from the government to this problem set. Clearly, we’re executing and we’re doing well.” That allowed us to raise $100 million, enough to build and flight test our first aircraft.

Now, we’ve kind of maxed out. The next contract, we need to go to hundreds of millions to unlock that next round of venture capital. It is significant leverage on every government dollar as the company has grown.

The next stage is raising hundreds of millions of dollars to develop the actual defense capability, the Darkhorse vehicle. The autonomous hypersonic aircraft will fly DoD missions. We’re going develop it privately. However, the government has to continue to buy it at a scale that’s relevant and necessary to get to that stage.

This is where it gets hard. The company now burns so much capital annually, that tens of millions of dollars isn’t even enough to sustain it. That’s why reaching recurring revenue is so important. To work with the government at the scale of hundreds of millions of dollars is the program that you have to build and get buy-in.

The Air Force is used to buying airplanes, and once we have an airplane that they can buy, it’s relatively straightforward. It’s this middle bit that is hard. You’re still developing the technology; you’ve got a product that is going to be coming online in a year or two and then the next one maybe two years after that. How do you sustain the company through that?

AL: So, how do you sustain it?

AP: A contract with the government for the plane that will be here in a year and a half. There’s a lot of work to accomplish ahead of actually flying it.

AL: Are you going to run out of funds before that happens?

AP: If we’re not successful at completing the technology development and getting the Air Force to say this is important enough to invest in at the scale of hundreds of millions of dollars, the company is dead in less than two years.

AL: And the Air Force is aware of that?

AP: Oh, they are for sure. Now, have they taken it to heart? Do they care enough? We’ll see.

AL: I assume this is where the relationship building that you’ve discussed is so important.

AP: The decision for a multi-hundred-million-dollar procurement or services contract, or even R&D contract, probably involves 50 to 60 people throughout the DoD, Congress, the Executive Branch, and the Office of the Secretary of Defense. You have to work your way through each of those people in the right order, at the right time. You have to make sure they understand what’s going on, what the value is, what the stakes are, what the urgency is, and what the big payoff is at the end. Luckily for us, our mission to develop operational hypersonic aircraft has a pretty massive payoff if successful. I think that’s a big reason why we’ve been able to get as much traction as we have. But at the same time, we’ve still got a lot of work to do on the technical side. And we still have a lot of folks we have to bring in. CM

ENDNOTES

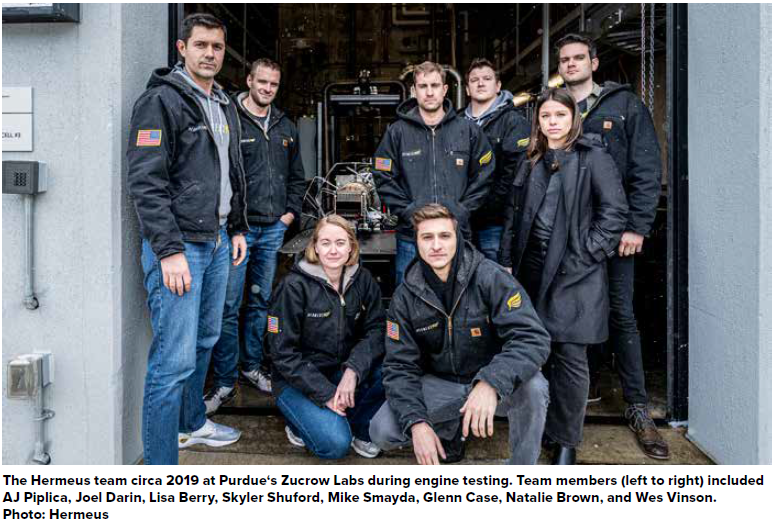

1 All four Hermeus founders worked together at Generation Orbit, where AJ Piplica served as CEO and Glenn Case, Mike Smayda, and Skyler Shuford served as technical directors. While there, they led the development of the X-60A, a hypersonic rocket-plane and the Air Force’s newest X-Plane. All besides Piplica are SpaceX and Blue Origin alumni. https://www.youtube.com/watch?v=hU4TlFGjh2E

2 O’Kane, Sean, “Amazon sent us a 13-page PDF to prove Elon Musk is as litigious as Jeff Bezos,” The Verge, September 29, 2021, https://www.theverge.com/2021/9/29/22700600/amazon-elon-musk-jeff-bezos-blue-origin-spacex-lawsuits; Davenport, Christian, “Peter Thiel’s Palantir scores a win in fight for lucrative Army contract,” The Washington Post, October 16, 2016, https://www.washingtonpost.com/business/economy/peter-thiels-palantir-scores-a-win-in-fight-for-lucrative-army-contract/2016/10/31/7e0682fa-9f8a-11e6-a44d-cc2898cfab06_story.html.